5 Cash Flow Tips to Save Your Startup

Hello Cash Flow. I Love You.

When I was 20, launching my first Internet company out of my dorm room at Babson College, I focused about 90% of my effort on building the product with about 10% on generating our first sale.

One area that never crossed my mind (until it was almost too late) was the timing of my startup’s cash flow.

For a neophyte entrepreneur, timing cash flow seems like something you can figure out later on in the life of your business, not something that requires your attention from day one. Sure, finance classes implored us to study the Statement of Cash Flows long and hard to decipher the inflows and outflows of cash streams into a business, but the area that seemed to continually stymie our startup’s growth rate was the availability of cash on hand when we actually needed it most.

Today, I’m sharing my Top 5 Cash Flow Tips to Save Your Startup. As founders and SMBs wait for their PPP deposits to arrive, many are either on the brink of collapse due to two months of zero revenue activity (but continuous expenses that must be paid in a timely manner), and some are preparing to re-open up as states ease back into the ‘new’ normal of operations. As I explained recently to founders that I advise:

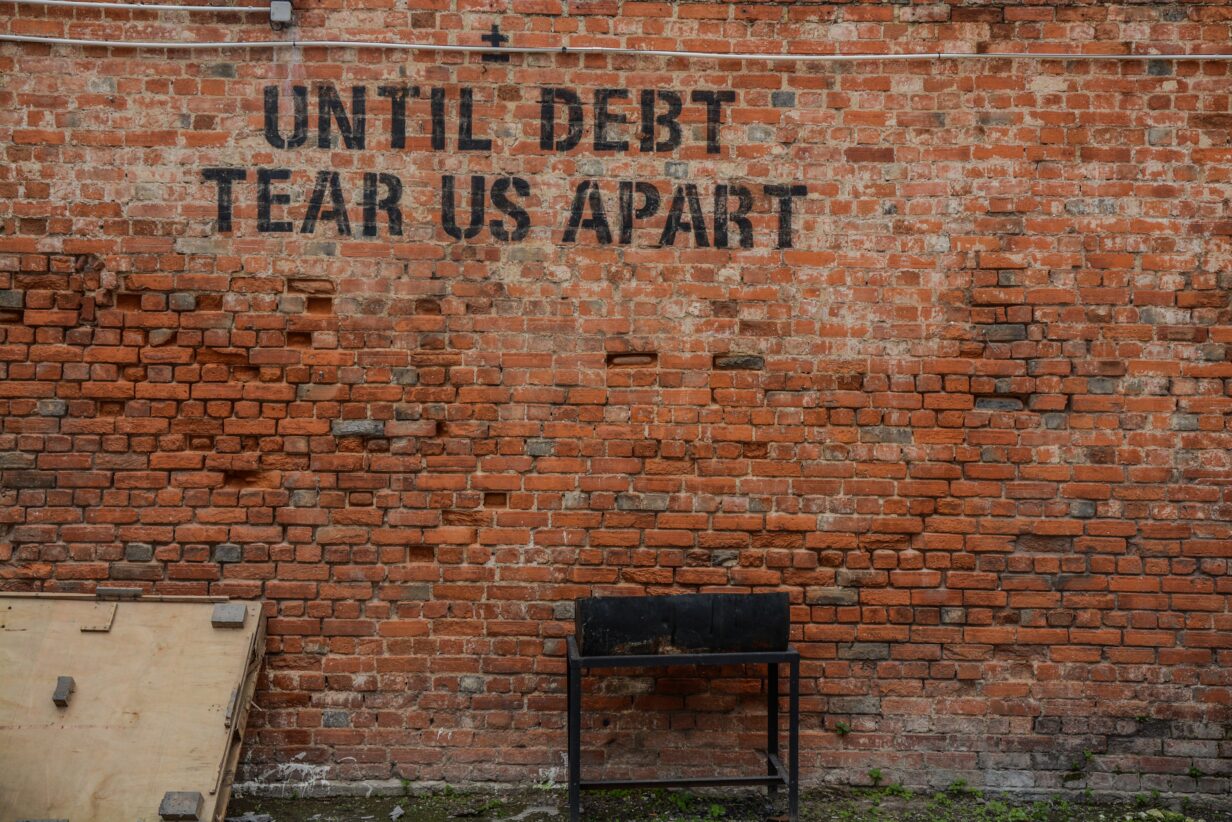

Cash is king, but in startups, cash flow is life.

Most businesses actually go out of business because of cash flow problems, not because of bad ideas, lack of leadership, poor marketing, wrong location, etc. Cash is king, but in startups, cash flow is life. The moment you lose it, you’re either begging for investment and giving up precious equity, paying exorbitant interest rates, or filing for dissolution.

Cash, on any balance sheet, is the first item that provides the most liquid form of solvency for any venture. The more cash on hand, the more you can fund growth, borrow from lenders or investors, and the better you will be able to meet payroll and accounts payables each month.

1. Timing your Receivables

Do you have a very routine cycle when you invoice your customers, or do you sometimes do it on the first of the month, and other times on the sixth day of the month when you’ve got time? The difference in time lapse is critical not only to receiving payment earlier than later, but also can be more in alignment to your customer’s normal accounting A/P dates. Instead of simply invoicing your customers on the day that’s most convenient for you, I suggest you check with their A/P department to inquire when they cut checks to suppliers. This will give you a better indication across all of your customers as to when they all prefer to cut checks, and by aligning your invoicing schedule to better match theirs (for the majority of them or for the ones that routinely owe you the most), puts your invoices on top of their stacks and ensures you get paid faster and more consistently – two great benefits for startups and SMBs.

2. Timing your Payables

Most companies receive invoices from suppliers either on the 1st or 15th of every month, and for other service providers whenever they ship you the goods you ordered (rolling basis). By advising all suppliers that you only pay invoices on the 1st and 15th of the month and not on a rolling basis (or stating that you only remit payment once a month via check but would be happy to pay by credit card) which gives you an extra 30 days to pay plus earns you reward points if you have them, helps your suppliers align to your preferred A/P cycle. This removes the constant barrage of collection calls requesting payment, and gives them two options 1) Early Pay via Credit Card (they have to accept 2-4% less for this usually) or 2) Adopt your A/P Cycle (for the full payment amount via check). Either way, you put your company on a more consistent track to time the outflows of your precious cash.

3. Discounted Cash Today is Better than Tomorrow

If you haven’t gone to business school, don’t worry, I’m going to sum up DCF (discounted cash flow) analysis in ten seconds for you — money today is worth more than money owed to you in the future. Uncertainty clouds money in the future – interest rates could go up, money markets could become more volatile, banks could restrict lending in five years, the list goes on — money today is worth more than promised in the future, so companies must discount their projected earnings in the future by a percentage (discount rate) to offset that agreed understanding.

For startups and SMBs, getting cash in today is often times better than waiting around for it in 3-12 months. For example, in lieu of only offering a monthly subscription, also offer an annual package at a 20% discount to capture a higher number of customers who want to pre-pay for annual access. Another example would be in lieu of invoicing a customer, mailing it to them, and waiting a week for it to arrive and 30 more days to it to become “due”, call them and offer them an early pay discount of 2% 10 Net 30 (they receive a 2% discount by paying in 10 days from receipt of invoice versus 30), or better yet, offer them a 5% discount by paying today over the phone with a credit card. Yes, you miss out on 5%, but it saves you labor hours calling and emailing them next month for collections and during uncertain times where many offices are closed, their A/P departments may be delayed in writing checks to suppliers to begin with. But, every manager has a company credit card in her pocket and can usually authorize a small invoice today. That puts money in your company’s pocket today, not sometime hopefully in a month.

4. Extending your Runway

When the future of a company’s revenue stream becomes unpredictable, and the times become uncertain, there’s one thing that every company – small, medium and large – must employ – to extend their cash runway. This means preserving cash that’s in the bank as best as possible. Cutting marketing expenses, tempering expansionary plans, delaying hiring, preserving core functionary roles, outsourcing to lower cost resources when possible, and pushing invoice payables out as far as possible. Extending the runway gives your airplane more time to build up speed to fly, not crash and burn.

5. Prioritizing Invoices

Make a list of all of your expenses (fixed and variable), and highlight them if they are due on invoice in yellow, due in 30 days in orange, due in 45 or 60 days in pink and then rank them as Crucial (1) for your Operations to function, Not Crucial But Supportive (2) for those that are important but not vital and Non Critical (3) for those that are perks during normal times but not critical today. Consider if you can immediately cancel all Non Critical (3) services without several impacting your business/culture. For Not Crucial But Supportive (2), consider pausing these services for a few months, or calling these suppliers to see if they can extend your payment terms or give you a few months for free. And the Crucial (1) areas should be re-ranked in order of most important to least, and the most important ones should always be given priority of payment whereas the others should be contacted to see if they can also extend some flexibility to your firm during these uncertain, volatile times.

While these 5 tips are not an exhaustive list of ways that can to help save your company’s cash flow during uncertain times, they’re really a no cost, easy way to start. The greater goal in evaluating the above, is to begin preparing your entrepreneurial mind to put cash flow first. With it, we thrive, Without it, we perish. Having a cash flow mindset helps new founders prepare for the worst and helps scale-ups grow during challenging times when others can’t.

photo by Alice Pasqual on Unsplash

Recent Comments